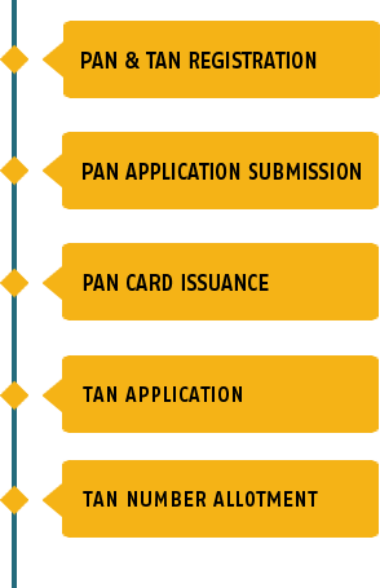

PAN & TAN Registration

Permanent account number (PAN) is issued to all juristic entities identifiable under the Indian Income Tax Act 1961. It is issued by the Indian Income Tax Department under the supervision of the Central Board for Direct Taxes (CBDT) and it also serves as an important proof of identification. This number is almost mandatory for financial transactions such as opening a bank account, receiving taxable salary or professional fees, sale or purchase of assets above specified limits etc.

Tax Deduction and Collection Account Number (TAN) is a 10 digit alphanumeric number issued to persons who are required to deduct or collect tax on payments made by them under the Indian Income Tax Act, 1961.

Required Documents for PAN & TAN Registration

PAN REGISTRATION :

- Address Proof

- PAN Card.

Partnership Concern

- Address Proof

- PAN Card.

Private Limited Company

- Memorandum of Association & Articles of Association

- Certificate of Incorporation

TAN REGISTRATION :

- PAN Card Xerox Copy (or) Partnership Deed (or) Memorandom

Partnership Concern

- Partnership Deed (Xerox Copy)

Private Limited Company

- Memorandum of Association & Articles of Association

- Certificate of Incorporation

Prabhakaran

HR Manager

"Thank you for your best support with ESIC & EPFO registration. It was a great support, Suresh!!!"

Kanagaraj

HR Manager

"Best support you have provided to my company. Thank you for the wonderful support, Bala Consultancy!!!! Keep up the good work"

Manigandan

HR Manager

"Excellent support for PF & ESI. Thank you, Suresh!"

Krishnan

HR Manager

"My Income tax and our company PF issues were handled by Bala Consultancy. They are result-oriented, efficient, making things easier for me, good people. Thank you for the good support!"

Vel Murugan

HR Manager

"Inquired for a help on GST returns and queries. I have got good suggestions and has been addressed timely. Thanks for the entire team working on that especially Suresh who always attend my calls without any hesitation at any time ... keep the good service going on...All the best ..."